The nickel price on the London Metal Exchange (LME) is holding up well – and so far successfully – against the general macroeconomic downward trend. It seems, therefore, somewhat surreal that the LME nickel market, precisely now, finds itself in a backwardation situation. This means that the spot price for immediate delivery is above the futures price (for example delivery in three months), despite good physical availability. In contrast to the 3 months future price, the spot contract is dealing with premiums of more than USD 200/mt at times, the highest level for 12 years.

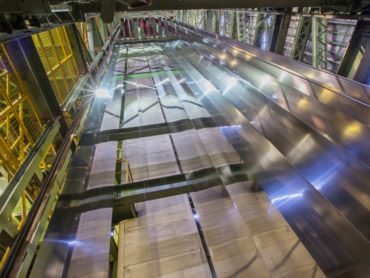

This situation can only be interpreted as a technical market distortion. Presumably there are market participants who are short in the near term i.e. holding short positions and, in market terms, can be squeezed by dominant market players. Not a nice situation, but a reality on the oldest metal exchange in the world. Contributing to this is that for a few days now, nickel has been seeing continual, and considerable, depletions from LME warehouses suggesting an increasing market tightness for spot delivery now becoming optically obvious. Should this continue, it would be surprising if the LME did not react.